What Growth-stage Startups Can Learn From Klaviyo's IPO

Three key lessons from the company that may have just opened the SaaS IPO market

The tech world is abuzz with the initial success of Klaviyo’s IPO yesterday. With shares of the Marketing Tech provider closing 9% above an already-exceeded price target and its valuation climbing to roughly $10B, many investors are hoping this means the growth SaaS IPO window is officially back open. While we’ll need more growth-stage SaaS businesses to successfully test the public markets before we can be certain we’re really back, there are three key tangible lessons any growth-stage startup with hopes of going public can take away from Klaviyo’s journey. Let’s dive in.

1. Understand your growth engine and use it to guide burn

One of the most impressive statistics to come out of Klaviyo’s S1 is the fact that they only needed $15.0M of net cash burn since 2014 to build a business with over $650M of ARR. When compared to the $8.9B and $6.0B Uber and Airbnb respectively burnt prior to going public, this feat is all the more striking. What explains these massive differences in burn rates? Growth engines.

Uber and Airbnb are two classic examples of network effects businesses where the value to customers / partners increases as more people use the platform. In businesses that exhibit such strong network effects, founders should follow the blitz-scale model Marc Andreessen popularized at Netscape by spending aggressively to achieve a dominant market position ahead of their competitors. The goal of this strategy is to get the market to tip in your favor as quickly as possible, because once it does the strong network effects create “winner-take-all” dynamics and can keep customers locked into your platform for a long time. Thus, a dollar spent on acquiring customers today can be recouped over many years.

Klaviyo, on the other hand, is not a business with strong network effects1. They sell software to a fragmented market where the incremental user does not provide material value to other users. This dynamic makes the market unlikely to tip, which means Klaviyo could afford to be more measured in their approach. By focusing on delivering high value to customers from the get-go and ingraining capital efficiency into their DNA, Klaviyo was able to sustainably build the business over time. As a result, Co-Founder and CEO Andrew Bialecki has been able to keep over 38% of the equity in the business, whereas Travis Kalanick and Brian Chesky held 11% and 7% at IPO respectively.

The takeaway for founders is clear: know how your business is positioned to grow, and spend accordingly. Bialecki could have been wooed by the “growth at all costs” mantra of Silicon Valley over much of the past decade, but he recognized that didn’t make sense for Klaviyo. In fact, I would argue that advice rarely makes sense for non-network effects businesses. Like Klaviyo, most founders in most businesses should focus on sustainable growth and capital efficiency if they want to improve their odds of success and retain ownership.

2. The public markets reward free cash flow, and you need to prepare for that

Classical financial theory asserts that a business is worth the present value of all its future cashflows. While growth investors in the public markets generally don’t base their valuations on a DCF (the future is too unknown for these businesses), they certainly do consider the long-term free cash flow generation potential of a business before making an investment. As such, before going public founders need to demonstrate they have firm control over the levers of their business and can pull them as needed. This is exactly what Klaviyo has done over the past year as they have prepared to go public.

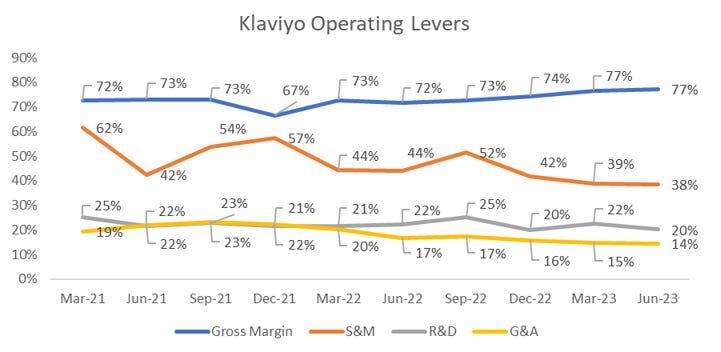

Since September of last year Klaviyo has improved Operating Margin from (19%) to 24% and Free Cash Flow Margin from (22%) to 4%. This is a clear indication to the public markets that Bialecki is in control of the levers of the business, which gives investors confidence profitability can further improve. How did Bialecki do it?

Across all major operating levers Klaviyo has become more efficient over the past year. Starting from the top line, Klaviyo raised price in their core email product to increase Gross Margins from 73% in Sep-22 to 77% in Jun-23. They have held Sales & Marketing spend roughly flat at ~$60M per quarter, which has resulted in 14pts of S&M margin expansion since September. Coupled with modest improvements in R&D and G&A margins, these actions have helped drive Klaviyo’s inflection to profitability.

This inflection is even more impressive when put in the context of Klaviyo’s sustained growth rate. In Jun-23 Klaviyo achieved 51% LTM growth, which represents 81% growth endurance off Jun-22’s 61% LTM growth figure. 81% growth endurance puts Klaviyo among best-in-class cloud SaaS performers, according to Bessemer benchmarks.

The takeaway for founders: Show the public markets you can control the levers of your business by optimizing for cost while still sustaining impressive growth. You will be rewarded.

3. There’s no shame in a “down round”

When Klaviyo initially filed for IPO, their indicated price range of $25-$27 per share implied a midpoint valuation of $8B TEV. When compared to their latest round of private financing, which valued the business at $9.5B in July of 2021, this represented a ~15% haircut to valuation despite two years of best-in-class growth. Let’s consider that more closely – even though Klaviyo more than doubled ARR, achieved profitability, consistently drove 119% net dollar retention, and posted an impressive 75% rule of 40, they still thought their business was worth less than it was two years ago!

As it turns out, the stock closed yesterday just north of that $9.5B benchmark, but this shouldn’t take away from the fact that Bialecki and team were willing to take a haircut on valuation in order to raise additional funding and get public. They recognized the $9.5B mark was a relic of the past, set during a time when excessive market liquidity and exuberance caused tech multiples to become dangerously detached from reality. Rather than focus on that past, Klaviyo chose to look forward, assess the market conditions as they are today, and made the best decision for the future of their business.

The takeaway for founders should be clear: Don’t be afraid of a “down round”. In fact, don’t even think of it as a “down round” when it’s really just a return to reality. If a scaled market leader with metrics as impressive as Klaviyo’s was willing to take a hit to their COVID-era valuation, you should be too.

Exciting times ahead

As I mentioned at the beginning, we’ll need more growth SaaS IPOs to test the markets before we can confidently assert the growth SaaS IPO window is back. However, Klaviyo’s debut is an encouraging sign filled with many invaluable lessons for growth-stage founders. I’m personally excited to continue to follow Klaviyo’s journey as a now public company and can’t wait to see the next wave of great SaaS businesses their success inspires.

1. You may be thinking to yourself, “But wait! Klaviyo highlights their “significant network effects” twice on page 2 of their Prospectus!” And in fact, you’d be right. On pg. 2 they note, “As we add more customers and more anonymized data on our platform, we are able to better refine our predictive models of consumer behavior. These network effects also enable us to continually refine our guided software recommendations to drive more impactful campaigns and specific actions.” There’s just one problem – these are not network effects.

What Klaviyo is describing are supply-side economies of scale, which are valuable but not nearly as valuable as network effects. The thing is, Klaviyo knows this. The way they have patiently built and scaled their company PROVES they know they’re not running a business with network effects, but like any good salesman they also know what investors are looking for. Just as every company trying to raise a round of venture capital right now is pitching themselves as “AI-enabled” to a sea of AI-hungry VCs, Klaviyo recognizes public market investors want to invest in businesses with network effects and is therefore marketing themselves in the best light possible.